10 Most Infamous White Collar Crimes

- Sam Bankman-Fried & the FTX Fraud

- Tyco International Accounting Scandal

- Ivan Boesky Insider Trading Scandal

- Michael Milken Insider Trading & Stock Manipulation

- Charles Ponzi's Original Scheme

- ImClone Stock Trading Case

- Elizabeth Holmes & Theranos

- WorldCom Accounting Scandal

- Enron Financial Collapse

- Bernie Madoff Investment Scandal

#10: Sam Bankman-Fried & the FTX Fraud

Once hailed as the “poster boy” for crypto, Sam Bankman-Fried rose to prominence as the founder and CEO of FTX, a popular cryptocurrency exchange. But his glowing reputation in the media was sullied when he was arrested in the Bahamas in December 2022. The allegations against Bankman-Fried were serious. He was accused of embezzling billions from FTX customers and investors, channeling these funds into Alameda Research, a crypto-trading hedge fund he co-founded. Through Alameda, Bankman-Fried used the money to make real estate investments and political donations. In the wake of these accusations, FTX declared bankruptcy. Bankman-Fried was extradited to the U.S. where he was tried and convicted on multiple charges including wire fraud, securities fraud and money laundering.

#9: Tyco International Accounting Scandal

Since its establishment in 1960, security systems firm Tyco International achieved considerable success, acquiring several smaller companies and generating billions in revenue. In the early 2000s, however, Tyco faced a scandal involving allegations of widespread financial misconduct by top executives. CEO Dennis Kozlowski and CFO Mark Swartz were accused of defrauding the company of over $150 million, which they used to fund their extravagant lifestyle. This included a lavish $2 million birthday party for Kozlowski’s wife on a Mediterranean island. The legal repercussions unfolded over two trials; the first ended in a mistrial, while the second led to the conviction of Kozlowski and Swartz. They were both sentenced to a minimum of eight years and four months in prison.

#8: Ivan Boesky Insider Trading Scandal

In the 1980s, Ivan Boesky, a prominent Wall Street arbitrageur nicknamed ‘Ivan the Terrible’, became embroiled in the largest insider trading scandal at the time. Boesky operated his own stock brokerage company and amassed immense wealth by speculating on company takeovers and mergers. His downfall began in 1986 when an SEC investigation revealed that Boesky had made investments based on confidential tips from corporate insiders. To mitigate the consequences, Boesky decided to cooperate with the SEC, providing information about others in the industry, such as Michael Milken. More on him in a bit. As a result, Boesky was fined $100 million and served only two years in prison, after which he was banned from working in the securities industry.

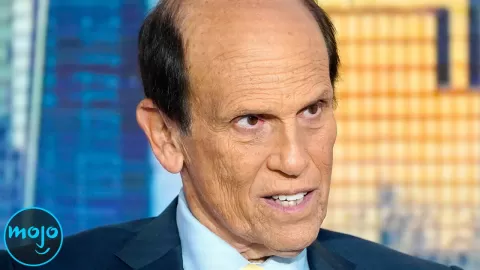

#7: Michael Milken Insider Trading & Stock Manipulation

One of the individuals implicated by Ivan Boesky was American financier Michael Milken. A key figure at the investment bank Drexel Burnham Lambert, Milken was known for pioneering high-yield bonds, or “junk bonds,” and came into contact with Boesky through this work. Boesky, who was one of his clients, later implicated Milken and Drexel Burnham Lambert in his illegal activities. An investigation revealed an intricate network of crimes, including manipulations of stocks and bonds, as well as insider information trading. Milken was subsequently indicted on numerous criminal charges and faced a lengthy prison sentence, if convicted. He later pleaded guilty to six counts of securities and tax violations, ultimately serving about two years in prison.

#6: Charles Ponzi’s Original Scheme

The classic Ponzi scheme takes its name from Charles Ponzi, an Italian immigrant who operated in the U.S. and Canada. In the early 20th century, Ponzi devised an elaborate investment scheme that ultimately swindled investors of about $20 million, equivalent to over $200 million today. Ponzi established the Securities Exchange Company in January 1920, which attracted a large influx of funds by guaranteeing investors a 50% profit within 45 days, or 100% within 90 days. However, this scheme was unsustainable as it relied solely on recruiting new investors to pay off earlier ones. Unsurprisingly, it collapsed in just a few months. Ponzi pleaded guilty to mail fraud and served time in prison, after which he was deported to Italy.

#5: ImClone Stock Trading Case

In 2001, pharmaceutical company ImClone Systems failed to get FDA approval for their experimental new drug, Erbitux. Prior to the public announcement of this decision, company insiders, including CEO Sam Waksal, tipped off their friends and families to sell their shares. The ensuing scandal gained widespread attention, mostly due to the involvement of lifestyle guru Martha Stewart, who had also sold off her shares shortly before the stock plummeted. Waksal was arrested in 2002 and sentenced to over seven years in prison after pleading guilty to multiple charges, including securities fraud. Stewart, on the other hand, pleaded not guilty to her criminal charges. Following a highly publicized trial, however, she was convicted and received a five-month prison sentence.

#4: Elizabeth Holmes & Theranos

It was a blood-testing technology that was initially hailed as revolutionary, but later turned out to be a massive fraud. Elizabeth Holmes founded Theranos in 2003, promising fast, affordable and accurate tests using small amounts of blood. If that sounds ludicrous to you, then you’re probably not one of several investors who raised over $700 million for Theranos. At its peak, the company’s estimated value reached $10 billion. But such great heights only meant they had further to fall. Things began to unravel in 2015 when it was revealed that Theranos’ technology didn’t work as promised, and Holmes had misled investors and patients. She was found guilty of wire fraud and conspiracy, and sentenced to over 11 years in prison.

#3: WorldCom Accounting Scandal

At the time of its discovery in 2002, this case was the largest accounting fraud in U.S. history. It involved WorldCom, then the second-largest long-distance telephone company in America. Under the leadership of CEO Bernard Ebbers, WorldCom executives inflated company profits over a three-year period to meet investor expectations and maintain their stock price. This was accomplished by manipulating accounting entries, essentially cooking the books, to present a false image of profitability. In total, this fraud amounted to $11 billion and was uncovered by a team of internal auditors. As a result, the company filed for bankruptcy and Ebbers was convicted of fraud and conspiracy charges, receiving a 25-year prison sentence.

#2: Enron Financial Collapse

One year before the WorldCom accounting scandal, another prominent corporation crumbled due to financial fraud. That corporation was Enron. Founded in 1985, the energy company enjoyed success throughout the 1990s. However, as competition in the industry became tougher, profits began to fall. The company’s leadership, including chairman Kenneth Lay and CEO Jeffrey Skilling, implemented various financial schemes to mask their losses, and deceive investors and regulators. As the truth emerged, Enron’s stock plummeted, resulting in the largest American bankruptcy filing at the time. Multiple Enron executives, including Lay and Skilling, faced criminal charges and were sentenced to prison. The scandal prompted the enactment of regulatory reforms, such as the Sarbanes–Oxley Act, aiming to ensure corporate accountability and transparency.

Before we unveil our top pick, here are a few honorable, or in this case, dishonorable mentions.

Allen Stanford’s Ponzi Scheme

Stanford Earned a 110-Year Prison Sentence for Selling Fraudulent Certificates Worth $7 Billion

Jordan Belfort & Stratton Oakmont

Pump-And-Dump Schemes, Securities Fraud, Market Manipulation... You Name It

Adelphia Financial Collapse

The Rigas Family, Which Owned Adelphia, Misused Company Funds, Resulting in Bankruptcy

Jack Abramoff Indian Lobbying Scandal

Efforts to Defraud Native American Tribes of $85 Million Led to a Huge Political Scandal

#1: Bernie Madoff Investment Scandal

If Charles Ponzi popularized the Ponzi scheme, Bernie Madoff perfected it. Madoff was a former chairman of Nasdaq who founded his own Wall Street firm. Through the wealth management arm of this firm, Madoff lured investors with the promise of consistently high returns of 10%, regardless of market conditions. In reality, it was an elaborate Ponzi scheme - one that defrauded investors of approximately $65 billion, making it the largest ever of its kind. Although doubts about his legitimacy had surfaced as early as 1999, it wasn’t until 2008 that Madoff was arrested after his sons turned him in. He pleaded guilty to 11 federal felonies and received the maximum sentence of 150 years in prison, where he died in 2021.

Did we miss any other notorious financial crimes? Let us know in the comments below.