Top 20 Times One Person DESTROYED a Company

#20: John DeLorean

DeLorean Motor Company

Sure, the iconic vehicle that bore his name took us Back to the Future in 1985, but John DeLorean probably wished he could go back in time himself. The eccentric auto executive launched the DeLorean Motor Company with bold promises and a $200 million war chest, aiming to disrupt what he saw as a stagnant industry. But it wasnt long before his ambition outpaced his execution. Production delays, ballooning costs, and underwhelming reviews of the DMC-12 signaled trouble. His decision to base manufacturing in Northern Ireland during the height of the Troubles only made things worse. When the company went belly-up, DeLoreans fate was sealed by a sensational cocaine trafficking charge in 1982 a desperate move, he claimed, to save his dying dream.

#19: Albert Dunlap

Sunbeam Products

Sunbeam Products had already weathered a rough collapse in the late 1980s, capped by bankruptcy and a hostile takeover. By the mid-90s, it looked like the worst was behind them until Chainsaw Al revved his engine. Hired in 1996 to revive the company, CEO Albert Dunlap, infamous for gutting workforces to goose short-term profits, promised a rapid turnaround. But when barbecue grill sales inexplicably spiked in late 1997, shareholders took notice. The truth? Dunlap had massively oversold to retailers, booking phony revenue to prop up the stock. When the fraud unraveled, Sunbeam took a $60 million hit, Dunlap was fired, and the company once again slid into bankruptcy this time, with his fingerprints all over the crime scene.

#18: Mitch Lowe

MoviePass

Stop us if this pitch sounds too good to be true: for a flat monthly fee, MoviePass subscribers could see as many movies in theatres as they wanted. No catch, no blackout dates, just unlimited access. And for a brief moment, that fantasy became reality. But behind the scenes, CEO Mitch Lowe was bleeding the company dry, chasing growth at any and all costs, and ignoring basic financial logic. As losses piled up, prices fluctuated wildly, and Lowe resorted to desperate tactics, like secretly resetting user passwords and blacking out popular titles like Mission: Impossible Fallout to stem the bleeding. The deception didnt save the company. MoviePass collapsed, dragging parent firm Helios and Matheson Analytics into you guessed it bankruptcy.

#17: Angelo Mozilo

Countrywide Financial

At first, the rise of Angelo Mozilo and Countrywide Financial reads like a classic American success story. Founded in 1969 by Mozilo and his mentor David Loeb, the mortgage lender grew from modest roots into a financial behemoth. But the next chapter is all too familiar. After once denouncing subprime lenders as crooks, Mozilo led Countrywide straight into the heart of the housing bubble, embracing risky loans and deceptive practices that would trigger the 2008 financial crisis. When the dust settled, Mozilo was branded the face of predatory lending. Countrywide collapsed and was offloaded to Bank of America, saddled with toxic debt and scandal. Mozilo, meanwhile, faced charges of insider trading and securities fraud, and became a lasting symbol of Wall Street greed run amok.

#16: Ron Johnson

JCPenney

By the early 2010s, JCPenney was already in trouble, and a 2011 scandal involving manipulated Google search results didnt help. Enter Ron Johnson, the retail mastermind behind Apples wildly successful stores, hired as CEO to stage a turnaround. Expectations were high. But what worked in Silicon Valley didnt translate to the department store floor. Johnson scrapped coupons and long-standing promotions in favor of sleek branding and everyday low pricing a move that alienated loyal customers almost overnight. Rather than course-correct, Johnson plugged his ears and doubled down, blaming shoppers for not getting it. Sales plummeted, losses mounted, and by 2013, the board had seen enough. Johnson was out and JCPenney was left in even worse shape than he found it.

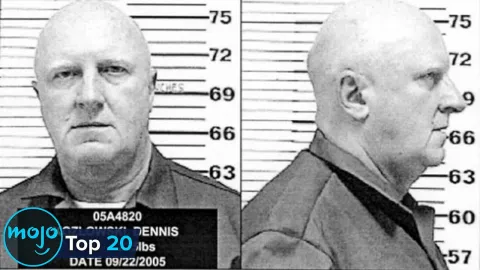

#15: Dennis Kozlowski

Tyco

Unfortunately for this security systems manufacturer, the call really was coming from inside the house. CEO Dennis Kozlowski, who took the reins in 1992, appeared to be steering Tyco toward prosperity, orchestrating high-profile acquisitions and building a reputation for trust and reliability. But behind the boardroom doors, Kozlowski was treating the company like his personal ATM. He used corporate funds to finance a wildly extravagant lifestyle, including a $2 million birthday party for his wife and millions more in unauthorized bonuses and forgiven loans, totaling roughly $150 million in all. In 2005, he was sentenced to prison for fraud, and Tycos credibility was left in tatters. The company never fully recovered, ultimately merging with Johnson Controls in 2016.

#14: Eddie Lampert

Sears

Touting himself as a visionary, chief executive and chairman Lampert sold Sears to Kmart in 2005 and set out to reinvent the company. And not through revitalized stores or improved customer service, but aggressive cost-cutting and financial engineering. He slashed budgets, pitted departments against each other, and sold off valuable assets like Craftsman and Lands End often to entities that were controlled by none other than Eddie Lampert. As stores crumbled and customers fled, Lampert was accused by Sears creditors of intentionally stripping the company for parts. By the time Sears filed for bankruptcy in 2018, the only thing Lampert had successfully preserved was his own stake in the wreckage.

#13: Sam Bankman-Fried

FTX

For a while, Sam Bankman-Fried looked like cryptos golden boy, a disheveled genius who promised to tame the digital finance frontier. His cryptocurrency exchange, FTX, exploded in popularity thanks to sleek marketing and celebrity endorsements. But behind the scenes, Bankman-Fried was orchestrating one of the largest ever financial frauds. He quietly funneled billions in customer funds to his hedge fund, Alameda Research, and then used the money to make risky bets, buy real estate, and donate to political campaigns. When the house of cards collapsed in 2022, over $8 billion had vanished. Found guilty on seven counts of fraud and conspiracy, Bankman-Fried was sentenced to 25 years in prison.

#12: Elizabeth Holmes

Theranos

Clad in a black turtleneck and channeling Steve Jobs, the Theranos founder captivated investors and the media with a machine she claimed could run hundreds of sophisticated tests from a finger prick. There was just one problem: it didnt work. Like, at all. Holmes built Theranos into a $9 billion illusion, propped up by manipulated data, aggressive secrecy, and flat-out lies. At one point, she even used commercial lab equipment while passing off the results as Theranos-made. When whistleblowers and journalists exposed the truth, the company collapsed. Holmes was convicted of fraud in 2022 and sentenced to just over 11 years in prison a spectacular fall for a woman once hailed as the next great Silicon Valley visionary.

#11: Richard S. Fuld Jr.

Lehman Brothers

As longtime CEO of the esteemed financial services firm, Fuld had a front-row seat to the subprime mortgage boom and couldnt resist going all in. Under his leadership, Lehman became addicted to risky mortgage-backed securities and toxic assets, even as red flags mounted across the industry. Fuld dismissed the warnings, doubled down on leverage, and refused to sell or merge when lifelines were still on the table. When the bubble burst, Lehman imploded with $600 billion in assets the largest bankruptcy in U.S. history which sent global markets into a tailspin and helped ignite the Great Recession. Fuld walked away disgraced, his legacy forever tied to one of the most avoidable collapses in Wall Street history.

#10: Gerald Ratner

Ratner Group

Gerald Ratner grew his family's modest jewelry brand into an empire on the philosophy that the loudest voice commands the most business. He learned the hard way that it's sometimes best to shut up. While speaking at a convention in 1991, the Ratner Groups CEO joked about his companys cost-effective mass production. He said the jewelry is so affordable because its total crap. His companys stock plummeted as insulted customers lost faith in the quality of Ratner products. The company won them back after the CEOs resignation and a rebrand. Today, Signet Jewelers is one of the biggest names in the industry. As for their old one, the consequence of a business rep getting too candid is called the Ratner effect.

#9: Eike Batista

OGX Petroleo

Energy industrialist Eike Batista quickly went from being one of the worlds richest men to a negative net worth. As hard as his companies were hit by his gambles, OGX Petroleo was particularly devastated. Batista got lucky when the company discovered major crude oil reserves. The parent company EBX Group spent the next few years driving Brazils infrastructure and energy, before finally going bust in 2012. Batista overpromised, underdelivered, and overspent on other ventures and an extravagant lifestyle. OGX then filed for the biggest bankruptcy in the history of Latin America. Under new leadership, it rebranded as Dommo Energia in 2017 and was sold to PetroRio in 2022. Meanwhile, the ever-reckless Batista was sentenced to 30 years in prison for corruption.

#8: Martin Shkreli

Turing Pharmaceuticals

Turing Pharmaceuticals broke out in 2015 with several major manufacturing licenses. Then Martin Shrekli raised the price for Daraprim, an antiparasitic used to treat HIV, from $13.50 per pill to $750. This reprehensible price hike made the so-called pharma bro a pariah. The companys reputation was further damaged by his callous social media presence and dubious pledges to make treatment more affordable. Shkreli claims the controversy prompted investigations into a potential Ponzi scheme and misappropriation of funds for his company Retrophin. He was ultimately convicted on securities fraud and conspiracy in 2017. Turing maintained ties after rebranding as Vyera Pharmaceuticals that year. But with Shreklis audacity leaving the company in a financial and legal mess, Vyera filed for bankruptcy in 2023.

#7: John Meriwether

Long-Term Capital Management

Scientific strategy and secrecy made Long-Term Capital Management an anomaly on Wall Street. For all of John Meriwethers brilliance, his leadership methods were not a long-term investment. His hedge fund saw three years of unrivaled profit before taking a hit from the 1997 financial crisis in Asia. After Russia defaulted on its debts the following year, LTCM lost billions in months. The decision to publicize some closely guarded trading methods further shook potential investors faith. The next closed-door deal was for a bailout, but LTCM dissolved in 2000. Experts blame Meriwethers very foundation of a fund that trusted the numbers and subverted trends, thus alienating potential partners. It would unfortunately not be the last time market volatility bested Meriwether's rationalist strategies.

#6: Adam Neumann

WeWork

The workspace design company WeWork was ironically felled by unprofessional leadership. Publicly, CEO Adam Neumanns eccentric image and excessive office culture undermined the companys credibility. Privately, he overindulged in illicit substances. He also directly manipulated business ties to serve his personal life and lofty ambitions for WeWork. Finally, in 2019, controversy over the business model and Neumann himself prompted him to delay the IPO launch. The CEO then voted himself out as the company became a laughing stock. WeWork is now considered a cautionary tale about giving too much power and agency to the head of an office. Even after COVID-19s impact on workspaces led to bankruptcy in 2023, WeWork continues to reject Neumanns efforts to buy it back.

#5: Aubrey McClendon

Chesapeake Energy

Innovations like fracking turned Chesapeake Energy into one of America's most powerful natural gas companies going into the 2010s. But CEO Aubrey McClendons own prosperity was partly based on financial creativity. In 2012, it came out that he was financing operations with personal loans from his company's own lenders. After his dismissal, McClendon was sued by his old company for selling data, then investigated for market manipulation. Forbes wasn't kidding when it dubbed him America's Most Reckless Billionaire before these revelations. McClendons schemes and downfall severely damaged Chesapeakes value. They experienced years of financial volatility before rebranding as Expand Energy Corporation following a merger in 2024. The day after he was indicted in 2016, McClendon died in a car wreck.

#4: Mike Lazaridis

Research In Motion

Mike Lazaridis and initial partner Doug Fregin essentially reinvented the cellphone with the multipurpose device BlackBerry. Unfortunately, he was less smart about business. That is where Research In Motion co-CEO Jim Balsillie came in, but he too downplayed the introduction of the iPhone in 2007. Despite the BlackBerry's superior engineering, other smartphones marketing and technical innovations convinced RIM to adapt. It was too late, and the two CEOs resigned shortly before the company was renamed BlackBerry Limited in 2013. They would both become cautionary figures for failing to recognize market trajectory. However, Balsillie and Lazaridis himself later acknowledged that it was the latter who fought the principles of restructuring. The struggling BlackBerry Limited discontinued its namesake product in 2022.

#3: Frank Lorenzo

Eastern Airlines

An industry staple for almost seven decades, Eastern Airlines struggled to adapt to that industrys deregulation in the 80s. Powerhouse manager Frank Lorenzo of Texas Air was poised to revive the company. The first order of business was a labor dispute, which Lorenzo actually made worse with harsh policies and deals. Pilots and flight attendants joined the labor strike, and the FAA issued a massive fine over safety violations. By 1991, Eastern was completely out of money. Lorenzos folly would go down as a tragedy of aggressive management. The punchline is that he bounced back after selling off Easterns assets to his other companies. Revivals of the airline have since failed to get off the ground.

#2: Nick Leeson

Barings Bank

It took Barings Banks 233 years to become one of the worlds leading merchant banks. It took Nick Leeson three years to tear it down. The derivatives trader was transferred to the companys Singapore office after he was denied a UK brokers license for failing to report a legal issue on his application. In 1992, he invested Baringss own money in futures without authorization, hiding shortfalls in an error account. Finally, the 1995 Kobe earthquake destabilized Asian markets and led to the discovery of Leesons no-longer-lucrative corruption. He ultimately cost Barings almost £1 billion, before the ING Group bought the company in 1995 for a single quid. Meanwhile, Leeson got four years in prison, his banking career killed alongside a centuries-old financial institution.

#1: Bernard Ebbers

WorldCom

Telecom Cowboy Bernard Ebberss company was one of the biggest in its industry. It turns out this was not accomplished honestly. WorldCom filed for bankruptcy in 2002, after Cynthia Coopers internal audit revealed extensive accounting fraud to bolster the companys stock. Up to $11 billion in overstatements were ultimately reported. Ebbers ousted his fellow executives, but investigations and convictions framed him as the mastermind. He had already fallen out of favor with the company over his lack of strategy following a failed merger with Sprint. The disgraced, financially devastated WorldCom would eventually be sold to Verizon in 2006 under the name MCI Inc. And in the years since his downfall, the once-renowned Ebbers is synonymous with executive incompetence and corruption.

What are some other memorable company catastrophes based on human error? Drop a tip in the comments.